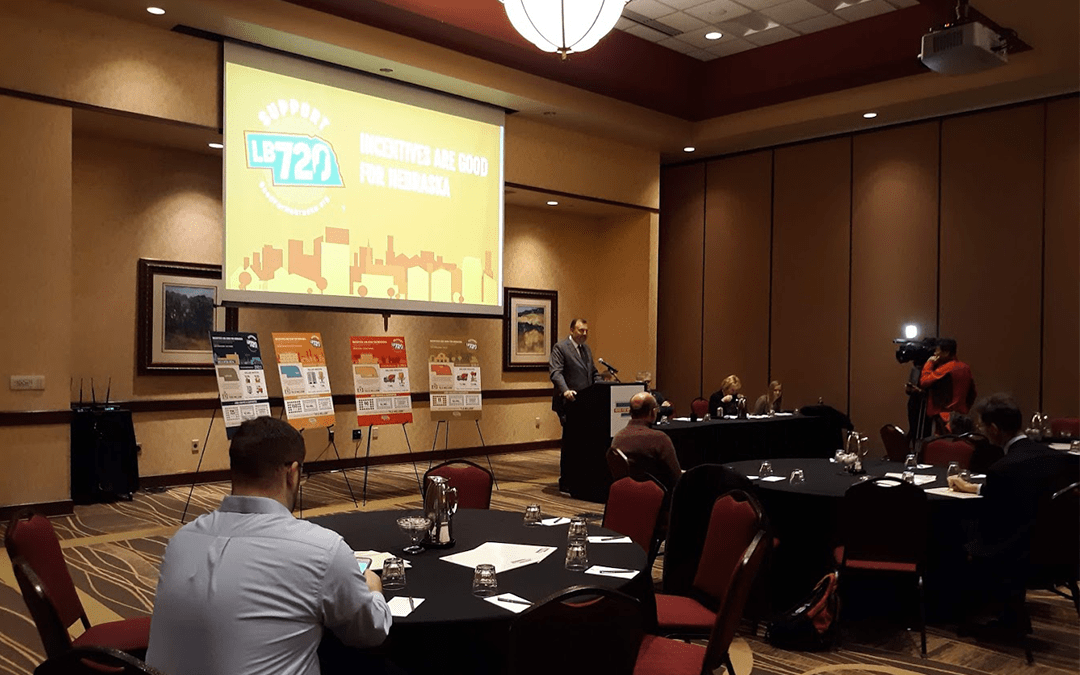

With all-in attitude applauding collaboration, Nebraska legislators, economic developers, community leaders and chambers of commerce executives rallied earlier this month in support of ImagiNE Nebraska (LB720), launching a statewide Good for Nebraska movement to reiterate the economic benefits of incentive programs.

“We are committed to implementing a robust, future-based incentives strategy that facilitates aggressive job growth and workforce development across the state,” said David G. Brown, president and CEO of the Greater Omaha Chamber. Brown also leads the State’s largest economic development partnership – a seven-county region representing 44 percent of Nebraska’s population.

ImagiNE Nebraska comes as Nebraska’s current economic incentives program, the Nebraska

Advantage Act, prepares to sunset in 2020. Since 1987, incentive programs have created nearly 110,000 Nebraska jobs, and sparked more than $35 billion in qualified investment for the State of Nebraska. Currently, all 50 states, as well as Guam and Puerto Rico, offer economic incentive programs.

“Job creation, economic growth, redevelopment and talent retention are keys to a prosperous future for our communities – a vision that can be realized with the appropriate economic incentives programs in place,” said Brook Aken, president of the Nebraska Economic Developers Association (NEDA).

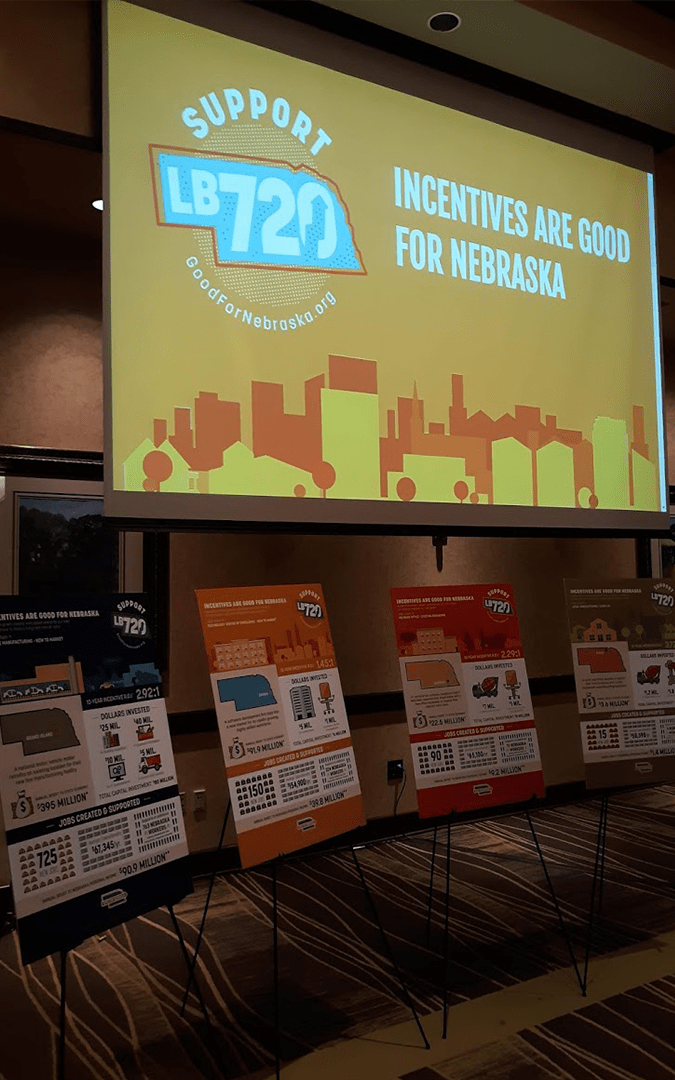

To illustrate the wide-reaching impact of economic incentives, Good for Nebraska supporters unveiled four hypothetical case studies illustrating the level of prosperity catalyzed by business growth in diverse communities. Examples included new-to-market manufacturing and tech businesses, as well as business-expansion projects and startup opportunities – all demonstrating growth resulting from economic incentives.

As an example, one new-to-market manufacturing facility can support as many as 763 related jobs statewide and boost personal income by $90.9 million annually.

The result, supporters say, is pervasive and profound, with a singular, statewide message: Incentives are good for Nebraska.

“Our communities cannot afford to take a timeout on incentives and lose ground in attracting more, good-paying jobs and skilled workers,” said Nebraska State Senator Mark Kolterman, the bill’s sponsor.

Regional news echoed support for the incentives initiative, with the Omaha World-Herald noting in a November 13 editorial, “LB720 contains many improvements over current law. It provides incentives for higher-wage jobs and shortens the payout time to reduce the chances of big fluctuations in year-to-year tax credit obligations. It sets differential wage rates for incentives to promote development in communities of all sizes. It removes overly complicated procedures in the current law.”

“Delivering tax relief and growing Nebraska’s economy go hand in hand,” said Nebraska Senator Lou Ann Linehan, Chair of the Legislature’s Revenue Committee. “We can’t achieve sustainable tax relief with a slowing or stagnant economy.”